1. What would the Collective Plan give me?

Contents

How much cash lump sum would I get?

What protection is there for my family?

Compare benefits in the Collective Plan to those in RMPP and RMDCP

How much income would I get?

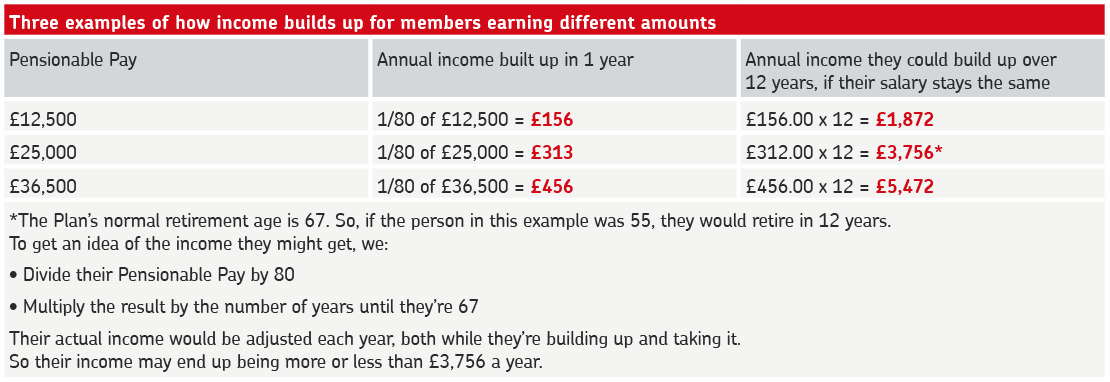

The Collective Plan aims to give you an annual income equal to 1/80 of your Pensionable Pay for every year you work.

The Plan starts off by giving you an annual income of 1/80 of your Pensionable Pay for every year you pay in. These amounts build up over the years. They’d also be adjusted each year, depending on how well the Plan’s investments are performing and how much the Plan expects to pay out to members.

This helps balance the cost of paying incomes and the Plan’s investments. So rather than giving you a guaranteed amount, what you get can be increased or reduced. Once you take your income, normally at age 67, the Plan carries on adjusting it each year.

Three examples of how income builds up for members earning different amounts:

The Plan aims to increase incomes each year to help them keep up with inflation. But there will also be years when incomes go down.

Here’s how different increases and reductions might affect someone’s annual income

How likely is it that the Plan might not be able to give increases, or might have to reduce incomes?

To answer this, the Plan and its investments were tested using two models:

- Model 1 looked at what would have happened if the Plan had been set up in the past. It used information about how the global economy and life expectancy have changed over the last 90 years.

- Model 2 looked at how the global economy and life expectancy might change over the next 30 years. It did this by considering hundreds of possible scenarios.

Both models suggest that over the next 30 years:

- Some years increases will be bigger than the rate of inflation and some years they’ll be smaller

- Incomes would average 1/80 of Pensionable Pay for every year someone works. Increases on top of that are likely to mean that incomes keep up with inflation, though in some years pension income may fall

What happens if there’s not enough money to pay people's incomes? If the Plan’s trustees think there will not be enough money to pay incomes, then incomes go down. Royal Mail will not put in more money. This is an important feature of the Collective Plan.

How much cash lump sum would I get?

Every year you pay into the Plan, you build up a cash lump sum. If you take your lump sum at 67, it will be equal to at least 3/80 of your Pensionable Pay for every year you've worked.

Cash lump sums build up in a different section of the Plan from your income. Under current tax rules, you should normally be able to take some or all of yours tax-free.

Here are three examples of how different levels of Pensionable Pay build up different amounts of cash lump sum

If the Plan’s investments perform as expected, you could get an increase on top of that

The better our investments perform, the bigger any increase could be. The investments for your cash lump sum are different to the investments for your income, so any increases are likely to be different too. For example, one could give you an increase of 1%, and the other an increase of 3%. If you’re given an increase to your cash lump sum, it’s guaranteed. So it cannot go down.

What would happen if there was not enough money to pay people's lump sums? You would get the lump sum you’ve built up. Royal Mail would cover the shortfall.

What protection is there for my family?

An income for your family after you die

The Collective Plan would pay an eligible partner a life-long income of half the amount you have built up in the Plan. It would also pay an income to your children while they’re under 18, or under 23 and still in full-time education. If you have one child, they’d get an income equal to half what your partner would get. If you have more than one child, an income the same size as your partner would get is shared equally between them.

These incomes are not reduced for early payment, if you die before you reach 67 – the Plan’s normal retirement age. Like any income from the Plan, they would go up and down once they’re being paid.

Any dependant income that you’ve built up in RMPP and any money that you’ve built up in RMDCP would be paid according to the rules of those plans.

A lump sum for your dependants if you die while working for Royal Mail

For people saving into RMPP or RMDCP, the lump sum from the Collective Plan may be smaller than you would get from your current plan. This is because it would currently include an additional lump sum of 2 x Pensionable Pay for members who have dependants. Also, pensionable Pay is different in different plans. Find out how the Collective Plan calculates pensionable pay

Ill-health benefits that pay you an income for up to 3 years

If you leave Royal Mail because of ill health and meet the eligibility requirements for this benefit, there is an insurance policy to top up Employee Support Allowance that you can claim from the government, so you get a total income equal to half of whatever your basic pay was when you worked for Royal Mail.

The insurance company pays you this money directly, and for up to 3 years. If you’re still considered too ill to work after 3 years, it may then pay you a one-off lump sum. The amount you get would be based on your Pensionable Pay when you left Royal Mail. Royal Mail pays the insurance premiums by deducting them from the contributions it pays into the Plan.

Casual employees are not eligible for this benefit. All other Royal Mail employees are eligible for the income this benefit pays. But only employees who are members of one of the pension plans are eligible for the lump sum.

If you’re paying into the Plan when ill-health forces you to leave Royal Mail and you qualify, you’ll also get any income and lump sum that you’ve built up in the Plan by then. These wouldn’t be reduced for early payment. Any benefits or savings that you’ve built up in RMPP or RMDCP would be paid according to the rules of those plans.

Frequently asked questions

To help you compare benefits, we’ve created a table you can download.

Being able to adjust incomes helps the Plan balance the value of its investments against the amount it expects to pay out as income in future. Adjustments can only be made once a year, on the first of April.

Being able to make adjustments means the Plan can respond if something unexpected happens, like a downturn in the global economy reduces the value of investments or people start living longer, so the Plan needs to pay incomes for longer.

When the value of the investments goes up or down, the Plan should be able to make a small adjustment to increases to try to get things back in balance. But if the Plan needs to, it will reduce incomes to get them back in balance.

Royal Mail and the CWU have tried to design a plan that does not favour one group of members over another. That’s why any changes would apply equally to everyone, whether the Plan is giving increases or reducing incomes. This means that the same rate of increase or decrease would be applied for every member’s benefits, whether they’re:

- building their income

- taking it

- have left Royal Mail and will take it in the future

The Plan reduces the impact of any decreases by:

- giving members notice of any reduction to their income

- spreading decreases of more than 5% over 2 or 3 years

Every year, the Plan's actuary calculates whether the Plan can afford to increase incomes or whether a reduction is needed. This exercise is called a 'valuation'.

The Plan's trustee then writes to members to tell them about any increase or reduction. We expect any increase or reduction to happen on 1 April.

If a reduction of more than 5% is needed, the change is spread over 2 or 3 years. Pension incomes will only change once a year.

Delivery companies generally offer a defined contribution pension scheme, in which employees build up an individual pot of savings and are responsible for turning those savings into an income when they retire. Employers tend to pay in 5% to 8%.

The Collective Plan automatically gives members an income for life and a lump sum when they retire, with Royal Mail paying in 13.6% of Pensionable Pay towards benefits and the Plan’s expenses.